Cook County Final Multiplier Announced

SPRINGFIELD – The Illinois Department of Revenue announces the final 2017

equalization factor of 2.9627 for Cook County. The Department is required by law

to calculate the factor, also called the multiplier, to achieve uniform property

assessment throughout the state. The 2016 final equalization factor was 2.8032.

The Department determines the final equalization factor for each county

by comparing the actual selling price of individual properties, over a three-year

period, with the assessed value placed on those properties by the county

assessor and adjusted by the Board of Review. If the median level of assessment

for all property in the county varies from the 33 1/3 percent level required by law,

an equalization factor is assigned to bring assessments to the legally mandated

level.

A tentative equalization factor of 2.9084 was issued on February 20, 2018.

The final factor is different than the tentative factor because of assessment

reductions by the Cook County Board of Review.

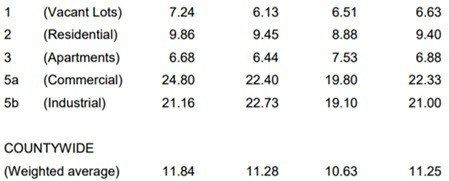

The three-year average level of assessments (weighted by class) for Cook

County property is 11.25 percent. The Department calculated the multiplier to

bring the average level of assessments to the required 33 1/3 percent level by

dividing Cook County’s three-year average of 11.25 into 33.33.

After taking into account the assessment changes by the Board of Review,

the levels of assessment are as follows:

Class

2014

2015

2016

3-Year

Average

The equalization factor does not cause individual tax bills to go up. Local

taxing bodies determine tax bills when they request the dollars needed to provide

services to citizens. The assessment process simply determines how the bill will

be divided among taxpayers.

A Cook County ordinance requires that residential property (homes,

condominiums, apartment buildings of six units or less) be assessed at 10

percent of market value; all other residential property (apartments with more than

six units), 10 percent; vacant lots, 10 percent; property owned by not-for-profit

corporations, 25 percent; commercial property, 25 percent; industrial property, 25

percent; and commercial or industrial property being developed in economically

deprived areas, usually 10 percent.